HIDDEN COSTS: Ex-teacher claims he pays ‘glorified loan shark’ RCS Group for services he was not made aware of

By Sy Makaringe

WHEN a retired teacher was issued with an RCS Group in-store card a few years ago, he thought he had been handed a passport to a flexible, convenient and pleasurable shopping experience at Game and Pick n Pay, two of the leading and popular retail brands in South Africa.

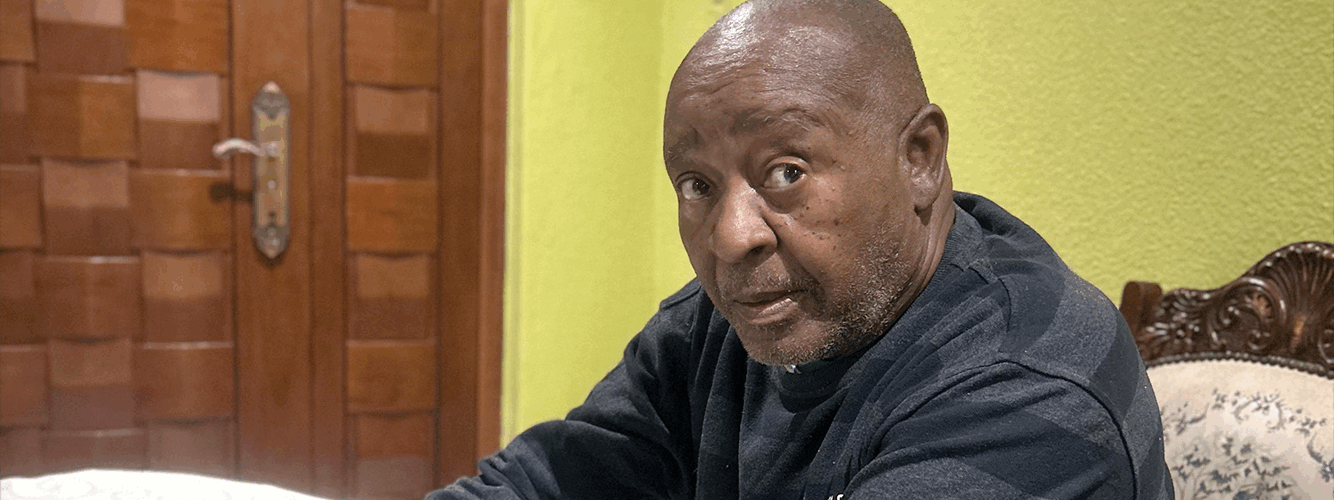

Little did 67-year-old Protea North, Soweto, resident Mashila Prince Baloyi know he was unwittingly entering a debt dungeon that would take him years to escape from, if at all.

RCS Group is a South African-based consumer financial services provider founded in 1999. It serves more than 2,2 million customers in South Africa, Botswana and Namibia. According to its company profile, the RCS Group offers credit solutions across some 30 largest shopping retailers in South Africa alone.

The company is a subsidiary of BNP Paribas Group, the sixth-largest bank in the world.

At the beginning of his association with the RCS Group, the septuagenarian used the in-store card on a few occasions to purchase appliances such as a refrigerator, TV set, electrical kettles and heaters as well as groceries on credit from both Game and Pick n Pay.

But the more he tried to keep up with his monthly repayments, the more his debt ballooned, almost spiralling out of control. That was because almost half of his monthly repayments was gobbled up by extra charges, including monthly interest of up 18,75%, administrative costs, insurance, subscriptions and “others”.

Weekly SA Mirror analysed a total of 70 statements of Baloyi’s Game and Pick n Pay accounts and found that of the R45 829 he has paid over a three-year period, only R22 202 went to service the debt whereas the rest – more than R23 600 – was “devoured” by what a frustrated Baloyi described as “hidden costs”.

“I call them hidden costs because no one from the RCS Group had told me about them when I signed up for the in-store card. I challenge anyone from RCS to produce proof that I had agreed to these insane charges,” Baloyi said.

He said had he known that he would be charged up to 18,75% interest on his monthly balance, he would definitely not have agreed to enter into what he now calls “a financially abusive relationship”.

Baloyi, a married father of two grown-up sons, said in an attempt to limit the “enormous and stressful financial burden” these accounts were having on him, he completely ceased making further purchases on credit from Game in August 2022 and Pick n Pay in July 2023.

“I haven’t bought anything from them on credit since then. But this did not help as the balances on both accounts continued to remain stubbornly high. As far as I’m concerned, the RCS Group is a heartless and greedy loan shark dressed in fancy corporate clothes,” the pensioner fumed.

At the time Weekly SA Mirror analysed both his Game and Pick n Pay accounts, Baloyi was still indebted to the retailers to the tune R19 000 (about R12 000 in case of Pick n Pay and R7 000 in relation to Game). It would appear that if the past trend were to be taken as a yardstick, he would still have to fork out double that amount to completely escape from the “debt trap”.

This is despite the fact that he had stopped making further purchases at both retailers two to three years ago.

Baloyi said he did not understand, for example, why he should be billed anything from R36 to R99 insurance a month on purchases he made at Pick n Pay as these were largely for perishables, which needed no insurance cover at all.

“As for goods such as TV sets, refrigerators, electric irons and kettles I bought from Game, these would be covered under my household insurance. So, what am I paying the RCS Group for?” an exasperated Baloyi asked as he threw up his hands in the air.

He also took issue with being charged an administration fee, which could range from R17,50 to R24 a month in case of Pick n Pay, and between R48 and R51 in case of Game.

“What are these administration fees for, and why must I, as a customer, be burdened with the responsibility of covering RCS Group’s administrative costs such as employee salaries, office space, etc.

“You see, R17,50 might look like a negligible amount for anyone to be really concerned about. But if you look at it in the context of the fact that RCS Group has more than 2,2 million customers, then you begin to understand how we, as poor customer, unknowingly finance the lavish lifestyles of a few businesspeople while we swim in a pool of debt,” said Baloyi. He said other “hidden costs” that needed some explanation from the RCS Group pertained to “subscriptions” and “others”.

“What am I paying for here? I’ve never subscribed to anything from RCS. What are ‘other’ costs for? RCS has a serious explanation to do here,” said an angry Baloyi.

He said he believed he was entitled to a refund on the line items that were “thumb sucked just to squeeze us customers dry”.

AIN’T DONE NOTHING WRONG: RCS RESPONDS TO CUSTOMER

WEEKLY SA Mirror emailed a detailed three-page inquiry to the RCS Group’s Cape Town headquarters asking it to comment on the various specific concerns that Soweto retired resident, Mashila Prince Baloyi (67), highlighted in his complaint.

The following is an unedited response we received from Mart Marie Smiles, of the RCS Group’s Customer Care Service Department, three weeks after we had sent the inquiry:

Interest and Fees

• We calculate interest, fees, and costs according to the National Credit Act 34 of 2005

• The interest rate that Mr Baloyi is charged was recorded on the pre-agreement and credit agreement that he concluded with RCS. This rate will never exceed the maximum annual interest rate permitted by the National Credit Act

• As explained in the contract provided to Mr Baloyi, Interest is be calculated daily and added to the principal debt monthly

• If the account is in arrears, additional interest will be charged on overdue amounts

Service Fees

• We charge a service fee for administering the credit facility, as permitted by the National Credit Act. There is a cost in managing and administering a customer’s account, which is covered by this fee

• The amount and frequency of the service fee will be set out in the pre-agreement. This fee was accordingly agreed to by Mr Baloyi when he entered into the credit agreements with RCS, and in the event of periodic updates to it, RCS complies with the National credit Act requirements on notice to customers

Customer Protection Insurance (CPI)

• Customer Protection Insurance is an insurance which is required (per the National Credit Act) for approved cardholders with an outstanding balance. It is protection for a customer’s credit balance, not insurance for the products s/he may have purchased

• Customer Protection Insurance provides cover for death, permanent disability, temporary disability, and loss of income. Should such an event occur, the CPI would cover the outstanding balance owed by a customer

• Full details and terms and conditions of Customer Protection Insurance can be viewed at www.rcs.co.za

Payment and Insurance

• Insurance premiums will be billed to the account and collected as part of the instalment

• The client will only have insurance cover if the account is not in arrears

Additional Information (CPI)

• The client have the right to waive Customer Protection Insurance and substitute it with a policy of their own choice, which covers the same benefits and which policy must then be ceded to us with certain written directions as stated in the National Credit Act

We trust that the above is in order and provides clarity on the concerns raised regarding the credit facility.