TRENDS: Despite challenges, the region has improved financial inclusion with adoption of digital financial services…

By WSAM Correspondent

Southen African countries performed well on their financial inclusion, between 2011 and 2021, owing partly to rapid adoption of digital financial services including mobile money.

This emerged this week during a dialogue by financial experts at a webinar on the African Financial Sector Southern Africa organised by the Economic Commission for Africa (ECA) in partnership with West African Economic and Monetary Union (WAEMU). The webinar was part of a series themed, “Regional Dialogues on the African Financial Sector”.

The aim of the regional profiles is to provide detailed information on the countries’ financial sectors, documenting recent trends, progress, challenges, and opportunities for a deeper financial sector.

In her opening remarks Eunice Kamwendo, ECA’s director of the subregional office for Southern Africa, noted the potential for growth, innovation and sustainable investments in the financial sector in Southern Africa.

“Southern African region’s financial sector faces financial challenges that include liquidity issues, debt distress, limited access to financial services, high levels of informality and regulatory constraints. Despite these challenges, it is important to prioritise the development of the financial sector to create stability, mobilise domestic resources and foster a stable environment for investment,” said Kamwendo.

Presenting a report on the demographic economic landscape of the Southern African region, Andrew Bamugye, senior investment manager SME at Trade and Development Bank, said the banking sector in Southern Africa has remained solvent with adequate capital; banking liquidity remained sufficient, with most banks seeing profitability between 2021 and 2023.

“The challenge in the banking industry in the region is the strong interconnection between the banking system and non-banking financial institutions and foreign markets, which leads to the risk of contagion,” said Bamugye.

He proposed that governments should increase fiscal space by expanding government revenues through diversification of the tax base and simplification of tax systems to reduce the exposure of banks to sovereign risks.

Punki Modise, chief strategy and sustainability officer at ABSA Bank, highlighted the varying levels of debt to GDP ratios across African countries and noted that some countries such as Kenya, Ghana, Kenya and Egypt have adopted unsustainable debt strategies. She also emphasised the importance of project preparation and bankability in the private sector.

“Authorities should enhance competition in the banking systems through the promotion of new players, especially those that help to improve financial inclusion,” she said.

In addition, she said banks operating in Africa need to have a more end-to-end approach to risk management, considering bankability at all stages.

On capital markets most countries in the Southern African region have a low market capitalisation. The Johannesburg Stock Exchange, which is the leading stock exchange in Africa, has a market capitalisation of $1022.8 trillion representing 133% of GDP in 2023, against 51.9% of Mauritius and 18.6% of Namibia.

A lack of liquidity characterises the bulk of the South African stock market and the breadth of the stock market in the region remains limited.

Furthermore, a small, listed number of companies and corporate bonds tend to dominate the fixed income market while the proportion of government bonds in the normal value is much higher.

“A deeper pool of insurers is required for the acceleration of green bonds growth in the region, especially among corporate borrowers,” said Mr. Bamugye.

According to the experts attending the meeting, the pension fund penetration remains low in most Southern African countries. However, the high pension penetration rate in South Africa, Namibia and Botswana were the result of good investment returns on the funds, based on a diversified investment strategy coupled with a strong asset allocation process,

Bernard Yen, actuary and managing director at Aon Solutions Ltd (Mauritius), highlighted the challenge of encouraging people in the formal sector to save and discussed the importance of structural changes to increase participation in pension funds.

He suggested that structural changes such as tax incentives and simplified registration processes could drive participation. He also emphasised the need for a multi-faceted approach to increase pension fund participation in the region.

“Countries should explore ways to increase participation of informal sector workers in multi-employer pension funds,” he added.

On the question of tapping into southern African SMEs, participants noted that the majority are financially constrained and face a lack of skills in corporate governance, financial management and often contend with high collateral requirements.

Bamugye noted the need to help SMEs develop bankable business plans and called for streamlining government support programs towards them.

He emphasised the importance of blended finance structures to address the challenges faced by SMEs in the region including the need for risk capital and conditionality and use of unfunded guarantees to unlock local liquidity.

He acknowledged the obstacle of bank credit access in the region particularly for SMEs and encouraged innovative and creative solutions to promote financial inclusion advising that countries should continue to explore innovative instruments and blended approaches to solve SME credit access problems.

UCT student turns yearning into thriving business

OPPORTUNITY: Johannesburg lass who craved for a ‘kota’ sandwich on arrival at varsity in Cape Town and couldn’t get one, saw a gap to establish a fast-food enterprise…

By Niémah Davids

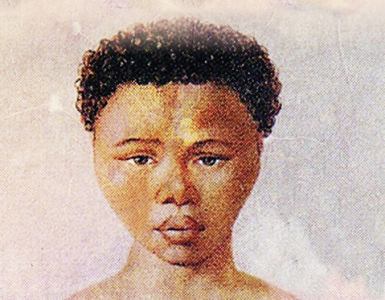

As a first-year University of Cape Town student in 2020, Khensani Khoza, was a long way from home in Johannesburg.

Lonely and navigating a new environment, Khoza yearned for face-to-face connections with her family because FaceTime and WhatsApp video calls just weren’t doing the trick. But what she really missed most was the food.

The thought of the food kept Khoza awake at night! The aromas from her mother’s kitchen and the perfect flavours that she got to enjoy at the end of a long day were what she missed most. Life as a first-year social science student was hard enough, and without those familial ties and familiar flavours her soul desperately craved, it was doubly tough.

Khoza scoured the areas near her UCT residence for meals that reminded her of home. What she longed for was a kota (a giant sandwich with a filling of your choice). But what the Mother City had to offer did not come close to what she was used to at home in Johannesburg. So, she chose to changed that. Thanks to her knack for cooking, Khoza fed her craving, and, before she knew it, she was feeding other students’ cravings too, selling kotas on campus. And the appetite for her product grew enormously. It seemed everyone was after the same kind of soul food.

“So many students enjoyed the kotas. There was clearly a gap in the market because I couldn’t keep up with the demand. In 2022, I was invited to exhibit at a campus market day and, as they say, the rest is history,” Khoza explained.

From tiny seeds, grow mighty trees. After her highly successful exhibit, Khoza launched “Build-a-Bite”, a street food business that prioritises students who are crazy about the kota.

Since the launch, she has also partnered with Food & Connect, a UCT student-focused food service provider and successfully integrated her concept into these outlets on campus.

Food & Connect provides Khoza with the kitchen space she needs to operate her business from. And her staff members are situated at outlets across campus to prepare kotas from scratch, servicing their growing market of hungry students and bringing them the flavours they love.

“The idea was to get into Food & Connect and to bring this service to other students who may not have been familiar with my little business, and it worked. They took a chance on a budding entrepreneur, and we are doing really well,” she said.

“I love bringing students who are not from Cape Town a taste of home through my food. Studying far from your family can be quite lonely. But the little things like a kota go a long way and we see that it has brightened many days.”

Khoza, who graduated from UCT in March, has big plans for her business, which includes taking it to other universities in the country.

And her market research, which she conducted among students at other universities in the country, including Cape Peninsula University of Technology, the University of the Western Cape, the University of Johannesburg and NorthWest University, has revealed an equally healthy appetite for the kota.

But branching out takes work. This, Khoza explained, includes conducting feasibility studies and ensuring there’s enough capital to successfully scale-up and sustain Build-a-Bite outside UCT’s campuses. It’s not a decision that she can make overnight.

“Entrepreneurship is so rewarding. But it takes a lot of hard work and dedication and the resolve to not give up. Branching out is a great idea and a dream for my business. But it requires enough capital to ensure that we are successful on that side. So, it’s not a decision that I can make in a blink of an eye. There are many pros and cons that need to be weighed up first,” she said.

Khoza described her journey as a successful entrepreneur as a rewarding whirlwind. She said it has brought with it endless challenges and opportunities and has forced her to think out of the box to ensure its success.

“The reality is that we need to be the change we seek for our society. We have the power to change things and so we must. Entrepreneurship is a calling, and it is a demanding venture, regardless of the kind of business you’re running. But it has the power to make the shift in society that we so need. It solves mighty challenges our communities face and benefits the entrepreneur and the consumer,” Khoza said.

And, despite the challenges that come with tough economic times, she said these challenges also serve as the driving force for opportunity and provide a platform for growth and development, especially for the entrepreneurially minded youth.

“When economies show up as dormant and non-progressive, it offers us new ideas and approaches that as young people we need to take advantage of. We can bring change if we’re willing to be the change,” Khoza said. – UCT